Foreign Exchange Risk (Part 3) – External Hedging Methods + Exam Questions

In our second post looking at FX risk we examined the internal methods of hedging available to a business to manage its FX risk. We will now turn our attention to the external methods of hedging FX risk as well as discussing an approach to the common style of FX risk exam questions.

External Methods

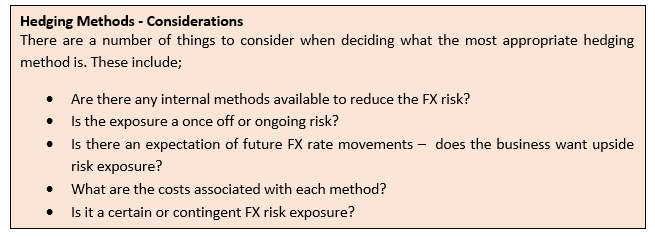

External methods involve dealing with third parties (e.g. banks or exchanges) to manage a FX risk exposure. There are a number of different methods within this group including forwards, futures, money markets, FX options and currency swaps – will will look at each below in turn.

Forwards

Forward contracts provide one of the most straightforward external hedging methods. A forward contract is a bespoke agreement between a business and a third party (typically a bank) by which the parties agree to exchange a certain amount of currency at an agreed rate on a specified date in the future. Thus the forward rates are rates that are agreed today for some time in the future (as opposed to spot rates which involve a transaction occurring today). Using a forward rate locks in a particular FX rate and thus businesses will not be able to take advantage of any favourable movements in FX rates in the intervening period. Many businesses, particularly exporters to the UK/US, will use forward contracts with banks to lock in a certain £/€ or $/€ rate for the next 6-12 months of trading based on their forecasted level of sales etc. – this provides certainty to these business for planning purposes

Futures

Currency futures provide a similar function to forward contracts in that they allow a business to lock in a particular FX rate in advance. However, unlike forwards, futures are standardised contracts that are traded in the futures markets. Thus they will have set maturity dates and contract sizes, which may not suit a business with particular needs.

Money Market

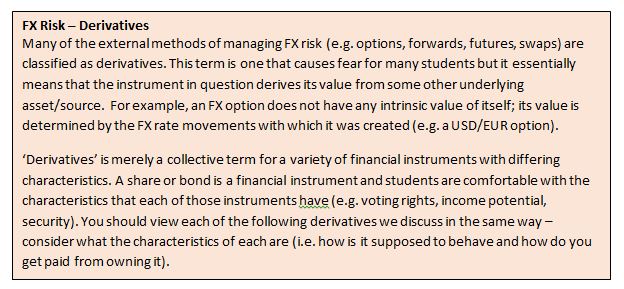

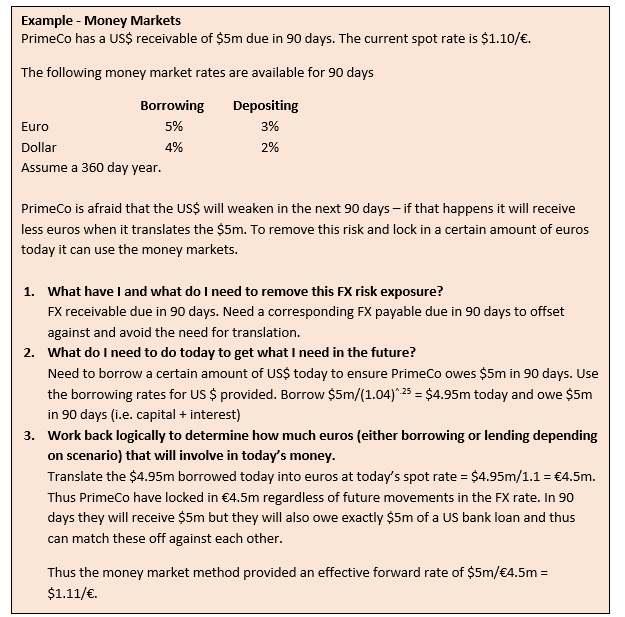

This method involves using the money markets (i.e. borrowing and depositing money) to create an effective hedge of an FX risk exposure. This is often known as creating a “synthetic hedge” as you are effectively locking in an FX rate today by using the money markets. How you approach the method will be slightly different depending on whether you have an FX receivable or FX payable you wish to hedge. With the money market method a business will lock in an effective rate – thus they will not be exposed to any down side movements in FX rates, but will not be able to take advantage of any upside movements if the FX rate movesin their favour.

A number of questions should help you identify what steps need to be taken to put a money market hedge in place;

- What have I and what do I need to remove this FX risk exposure?

- What do I need to do today to get what I need in the future?

- Work back logically to determine how much euros (either borrowing or lending depending on the scenario) that will involve in today’s money.

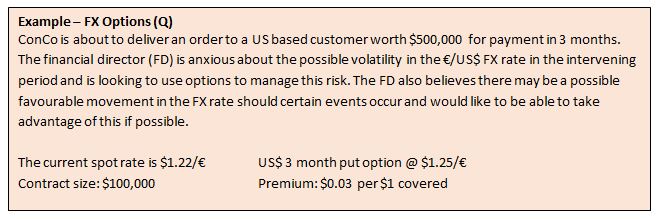

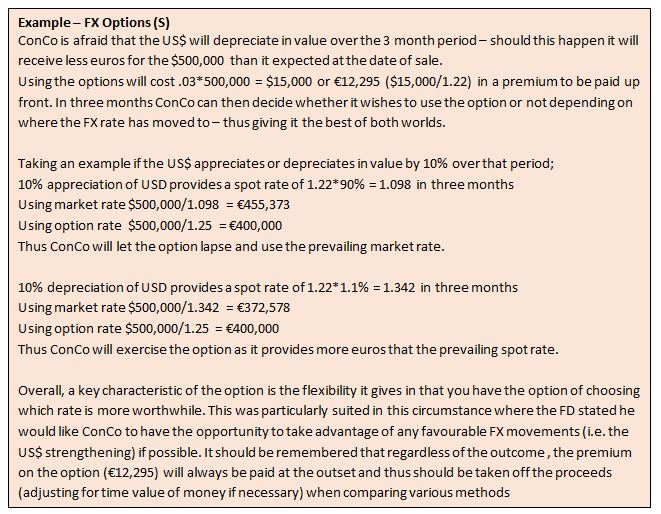

FX Options

Options give the holder the right, but not the obligation, to buy or sell (a call option gives the holder the right to buy the underlying currency and a put option gives the holder the right to sell the underlying currency) a predefined amount of a particular currency at or before (depending on the type of option) at specified date at a pre-agreed exchange rate. Thus in comparison to forwards, futures and the money market alternatives, options provide more flexibility to the business in that if FX rates move favourably, the business can take advantage of this by not being locked into a particular rate (this is commonly referred to as asymmetric risk exposure). However, a business must pay an upfront fee known as the option premium for this benefit. This must be paid regardless of whether the option is ultimately used (known as exercising the option) or the option is ignored (known as letting the option lapse) – similar in concept to paying an insurance premium.

Currency Swaps

Currency swaps are typically longer term arrangements which involve the swapping of cashflows in one currency for those of another currency. This allows the two parties in the swap to effectively lock in an FX rate. A bank can either assist in facilitating a currency swap (by finding a party who is willing to enter into a swap with you) or they may take the opposite side of a swap agreement themselves. The bank typically charges a fee for facilitating the swap. Typically swaps are used to hedge foreign debt transactions (e.g. a company having debt in a foreign currency but would like to minimize any FX risk associated with its repayment).

Approaching an FX question

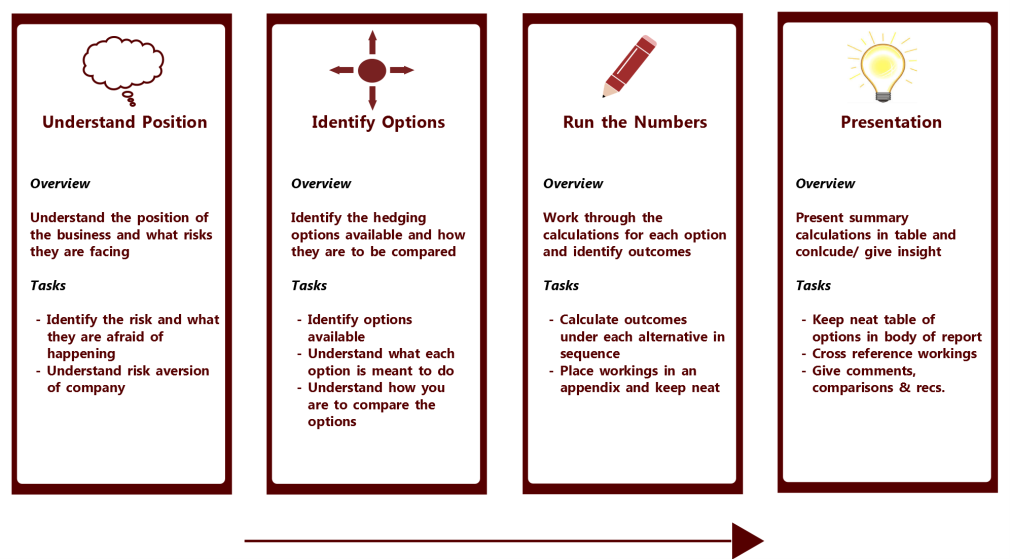

The typical question at CAP2 SFMA regarding FX Risk is to prepare calculations using different hedging methods based on a variety of scenarios. Students should follow a four step approach when answering these types of questions;

- Identify what the company is afraid of happening (e.g. the foreign currency strengthening or weakening) and what is the risk appetite of the company (do they want to be 100% hedged or to have some exposure to upside risk?)

- Consider the question framework – how many hedging methods are you asked to examine (Note you can be asked to show what happens if you don’t hedge also) and under how many scenarios?

- Prepare the calculations in an appendix leaving a blank page at the start to prepare your final answer table with each hedging method on the vertical and each scenario in a column across the top. Note: Always start with the easier alternative (e.g. do nothing if it is in the question) and work towards the hardest one – this will allow you build some confidence and marks.

- Fill in the final table as you prepare your calculations. Always remember to pay attention to the wording of the question and in particular to address any narrative/commentary requirements once you have finalised your table.

There are screencasts available which provide a walkthrough of past CAP2 exam questions on FX risk using this four step approach.

Summary – FX Risk Management

While understanding what FX risk a company has based on its business model is the first step in effectively managing its exposure, the next step is to put in place a plan to effectively management (or hedge) this FX risk exposure to avoid any adverse consequences to the business.

FX risk management is an important topic on the CAP2 SFMA syllabus and also forms part of FAE core and the FAE APM elective. There are three posts in this FX series; (i) Introduction; (ii) Internal Hedging Methods; and (iii) External Hedging methods (above).

It is important that students are comfortable with the different types of hedging methods available to manage FX risk (both internal and external). Students should ensure they understand the characteristics of each of the different types of external methods (i.e. options, forwards, futures, swaps) before attempting numerical questions on them. The different characteristics of each method can mean that some are more appropriate than others depending on the facts of the question. The majority of exam questions on this area follow a similar structure each time and students should ensure they have a tried and tested approach to these questions (see the four step approach suggested above along with the related screencasts).

I have enjoyed reading this article. I have benefited a lot from both Part two and three. My knowledge about internal and external hedging has increased quite a lot.