Silicon Valley Bank Collapse

The recent news of the collapse of Silicon Valley Bank (SVB) as a result of a run on the bank has created headlines around the world and for any student of accounting and finance it provides a great insight into several key topics from your studies. Below I have tried to split out some key areas from the story that students might be interested in reading a bit more about and applying to their own studies. From bank business models, matching assets and liabilities, liquidity management, interest rate risk, company valuations, M&A, financial reporting and audit reports, there is something for every student to take away from this story. It is also far from over so do keep an eye on how things unfold over the coming months.

SVB Business Model and What Happened

The nature of a bank’s business model is taking in deposits (paying a lower rate of interest) and lending this money out (with some leverage) and charging a higher rate of interest. This can ultimately cause a mismatch between liabilities (deposits) and assets (loans) and if there is a run on deposits (i.e. customers want all their money back very quickly), a bank can have a liquidity issue and go bust. Interest rate, and not credit, risk was the big issue in SVB however as a lot of the funds the bank had were invested in bonds, not loans to customers. With customers looking for their deposits back, SVB had to sell some of these bonds, realising a large loss, and so the cycle began in terms of a crisis in confidence in the bank and more customers looking to take their deposits out.

- Bank Runs, Crypto Concerns and Takeovers: A Timeline of the Panic – NY Times

- Banks are designed to fail – and they do – Martin Wolf, Financial Times

- What Does the Failure of Silicon Valley Bank Say About the State of Finance? Harvard Business School

- SVB Bank Run. Is 2023 a re-run of 2008? David McWilliam Podcast

- Money Talks: What went wrong with SVB? Money Talks Podcast, The Economist

Interest Rate Risk

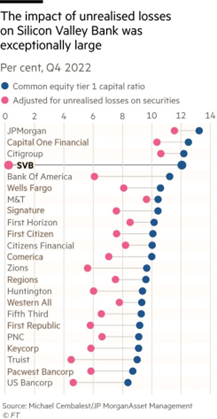

At the heart of the problem for SVB was its exposure to interest rate risk and a lack of risk management. Holding billions of bonds when interest rates were rising meant the bank was sitting on huge unrealised losses – remember Finance 101 and time value of money, when interest rates go up, the price of a bond falls. This wouldn’t be an issue if the bonds were going to be held to maturity but SVB needed to sell some of them to pay back deposits that its customers were now looking to take back. Despite this large portfolio of bonds and associated interest rate risk, SVB had little, if any, formal hedging of this risk in place.

- Silicon Valley Bank: A Failure in Risk Management – Global Association of Risk Professionals

- Silicon Valley Bank: how interest rates helped trigger its collapse and what central bankers should do next – The Conversation

- SVB Couldn’t Ignore Its Losses, But the Fed Can – Matt Levine, Bloomberg

- Disastrous Risk Management Is Not the Fed’s Fault – Alfonso Peccatiello, Investing.com

Company Valuation & M&A

In the UK, a last minute deal was struck with HSBC to save the UK division of SVB. This was done under the guidance of the UK Government and the Bank of England with a core objective of avoiding the collapse of many key British tech companies that had deposits in SVB UK and to avoid wider uncertainty in the financial system. For HSBC, Europe’s largest bank, the deal makes sense in that it quickly gives them access to a new cohort of fast growing, innovative companies at a nominal £1 cost. This valuation reflects the uncertainty involved in the deal along with the time sensitive nature of the process (it is essentially a fire sale) – it is likely HSBC will record a gain from this transaction when the full financial reporting of the deal is complete (see next section).

The below links provide a great insight into the speed at which the deal was done, how it was run (there were several reported interested bidders and the HSBC offer was not the highest financially but was seen as the most attractive overall for stability), and the rationale for HSBC getting involved.

- HSBC rescues British arm of stricken Silicon Valley Bank – Reuters

- HSBC to buy Silicon Valley Bank UK for £1 in rescue deal – The Guardian

- The one pound rescue: inside the rush to save Silicon Valley Bank UK – Reuters

Financial Reporting/Auditing

There is also an important financial reporting angle to this story. The billions of bond investments held in SVB were classified as held-to-maturity which meant any fair value gains or losses (in this case large losses due to rising interest rates) were not recognised in the company’s financial statements. This would be fine if the assets did not have to be sold, and were actually going to be held to maturity, but as we now know this was not the case as bonds had to be sold to fund customers deposit withdrawals. This is not unique to SVB however – the below FT graphic highlights how much unrealised losses banks have (in total and relative to their capital base) on similar financial instruments.

Source: Banks are designed to fail – and they do

Another financial reporting angle to this will be the accounting for SVB UK in HSBC’s consolidated financial statements. As this was a fire sale, and SVB UK was bought for just £1, it is likely it will result in a gain from bargain purchase being recognised. HSBC say as much in its press release.

Finally, there is also an audit angle to this story. KPMG are SVB’s auditors and had only recently (late February) signed off on the company’s audit report.

- The SVB Collapse: FASB Should Eliminate “Hide-‘Til-Maturity” Accounting – CFA Institute

- HSBC acquires Silicon Valley Bank UK Limited – HSBC Press Release

- KPMG stands by audits of Silicon Valley Bank and Signature Bank – Irish Times

A fascinating story (especially from an accounting/finance educational point of view) and one that has a lot more to run.

no comments