Public to Private – Applegreen

The path of a private company deciding to list its shares on a stock exchange (a process known as an IPO – Initial Public Offering) is one that is covered in most corporate finance courses and plenty of examples spring to mind with another high profile IPO happening in the US just last week for Airbnb.

However, the opposite path, that of a public company going back private, is one that is less focused on and also an important area of corporate finance. The announcement from Applegreen, the listed fuel and forecourt operator, last week that its founders, partnered with the US based Blackstone Private Equity group, are planning to buy out the company (for an offer of €5.75 in cash) and take the company private again brings this back into focus.

IPO to Now

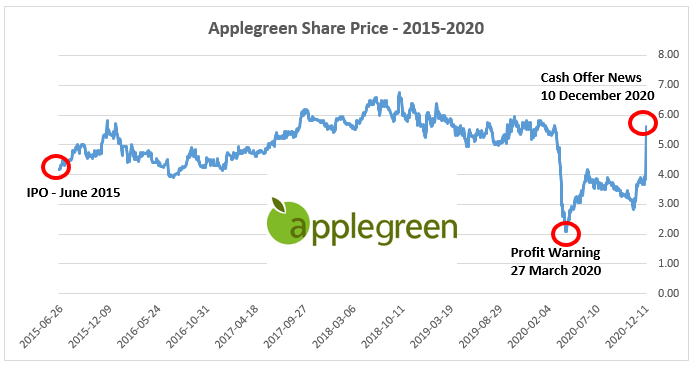

Having listed as a public company in June 2015, Applegreen’s share price hasn’t made much progress over the past five years which would have been a source of frustration for the management team given the level of US based expansion that has occurred during that period. As can be seen from the share price graphic below, the release of the annual results on 27th March 2020 was coupled with a profit warning for 2021 given the impact of COVID-19 on the business and consequently the share price fell significantly and never really recovered for the rest of 2020. The announcement of the cash offer on 10th December resulted in a big jump in the share price up to €5.50 as if the transaction goes ahead then each shareholder will receive €5.75, a nice profit for anyone who made this trade in recent days. There is of course the risk that the deal does not go ahead (called execution or closing risk) but given that the founders own in excess of 40% of the business currently and that it looks highly likely that the independent Board of Directors of Applegreen will recommended acceptance of this offer to the shareholders, it looks like it will be completed

Source: Applegreen Investor Website

Why Private?

So, why take the company private after all the work in the IPO only 5 years ago?

With little progress in Applegreen’s share price over the past few years, coupled with the big hit it has taken this year due to COVID, there would likely be frustration within senior management (who are the founders and driving this private transaction) as the company needs capital to invest in its growing US operations. Undervalued shares mean a very expensive source of finance if it needs to raise additional equity capital (as lower price shares means needing to issue more shares to raise the same amount of capital, which dilutes the ownership of the business). Applegreen also has significant debt currently in its consolidated financial statements which may have limited its potential to raise debt finance to fund further growth if it remained as a public company. Thus by going private the company can focus on growing its US based operations without the constant glare of the public markets and the need for quarterly reporting of results. The inclusion of Blackstone provides the capital base and expertise to allow them to continue their growth strategy abroad. The transaction will also likely provide an opportunity for both founders, Bob Etchingham and Joseph Barrett, to sell some more of their shareholding (also known as “taking money off the table”) as the press release merely states that they will retain a “significant equity” stake as well as their current positions of CEO and COO.

Key Takeaways

The route to public markets is not all one-way traffic and there are plenty of examples of companies that have returned to private ownership (e.g. Dell, Hilton Hotels, Heinz, Alliance Boots…… and of course Elon Musk also infamously tweeted his plan to take Tesla private in 2018, which ultimately came to nothing!). These “take-private” transactions usually involve a large private-equity group, or a group of private-equity firms, who acquire the shares of the publically traded company sometimes in partnership with key management.

Some of the reasons for taking a public company private can include;

Less Short Term Focus

Being listed on a stock exchange means a constant focus on quarterly reporting of results and the need to try to meet or exceed analysts’ expectations. Missing these expectations can lead to a big drop in the company’s share price and negativity with respect to the company. Such short term horizons can tie up management’s focus and efforts and take away from the long term strategic goals of the business. Taking a company private allows the management team to move away from quarterly reporting and focus on the longer term strategy of the business with little focus on short term volatility in its share price.

Less Compliance Costs

Taking the company private also reduces compliance costs which are associated with a public company such as ongoing regulatory, securities, and corporate governance rules. Additional costs including stock exchange listing fees, an investor relations department and increased reporting requirements can also be removed or at least significantly reduced once a company is taken private.

Access to capital

An under valued share price on public markets makes access to equity capital very expensive. Taking a company private and partnering with a large private equity fund (e.g. Blackstone) provides a depth of new capital for acquisitions and growth. These deals can also been completed in much shorter timelines compared to the regulatory approval processes that would be required if listed on public markets.

Reading Links

- Applegreen Regulatory Announcement

- Applegreen chiefs and Blackstone plot €694m bid for fuel retailer – Irish Times

- Departure of Applegreen will diminish the Iseq – Irish Times

- Applegreen founders in bid to take company private – RTE

- Applegreen considering takeover offer by founders and Blackstone – Irish Independent

no comments