Foreign Exchange Risk (Part 1) – Introduction

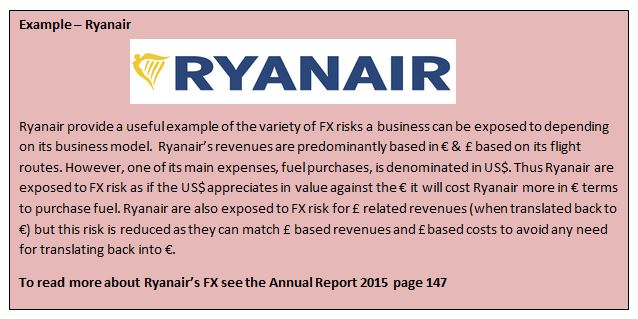

One core concern of the finance (or treasury) function in a business and one of the main services the finance industry provides is the area of risk management. While businesses are exposed to a variety of financial risks (e.g. commodity price movements, interest rate movements etc.) and have a variety of mechanisms to reduce such risk exposures (e.g. hedging fuel prices like Ryanair, borrowing at a fixed rate from a bank), the purpose of this post is to focus on one particular financial risk firms face – foreign exchange risk.

Regardless of firm size, location or sector, it is likely that a business has some exposure to foreign exchange movements. This risk can either be direct (e.g. the company sells to US based customers or buys from UK based suppliers and hence its business is directly impact by any movements in FX rates) or indirect (e.g. a wholly Irish based company with Irish customers and suppliers but movements in FX rates could make it more (or less) attractive for foreign competitors to export to Ireland or enter the Irish market and thus still impact the company).

The ability for companies, even large multinationals, to predict foreign exchange movements is limited and thus it is critical for firms to be able to understand their FX risk exposure and to put in place an effective plan to manage such risk. While many will argue that the FX market movements are random and that hedging is too expensive, leaving a business exposed to unfavourable swings in FX rates can have a significant impact on a business and furthermore there is an inherent value to certainty and the ability to plan effectively without unforeseen market movements, over which you have no control, taking over.

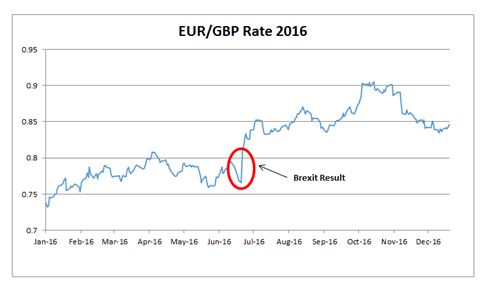

Recent Events – Brexit & US Election

Recent events such as Brexit and the US presidential election illustrate the impact that FX movements can have on businesses. Since the Brexit result there have been numerous stories of businesses being impacted by the weakening of sterling (See graph below). See below for a collection of headlines related to this issue – e.g. price increases being put through by businesses due to increased costs & competitiveness issues for Irish exporters into UK due to stronger euro.

Types of FX risk

When looking at the concept of FX risk there are three different types of risk commonly discussed;

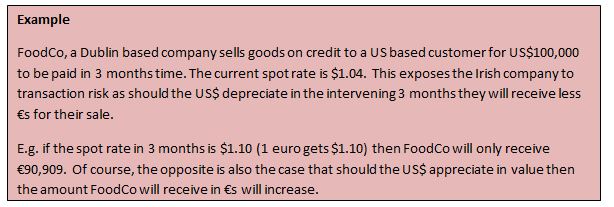

Transaction Risk – this is a specific and defined FX risk resulting from a transaction entered into that will be settled at some time in the future. This risk can impact the cashflows to the company. This type of risk is typically the focus of the hedging questions provided in an exam.

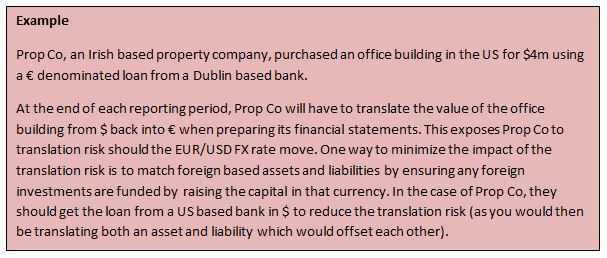

Translation Risk – this risk is related to the financial reporting of assets and liabilities that are located in a different region or are denominated in a different currency (IAS21). It does not impact on the company’s cashflows but it can impact the reported earnings and financial position.

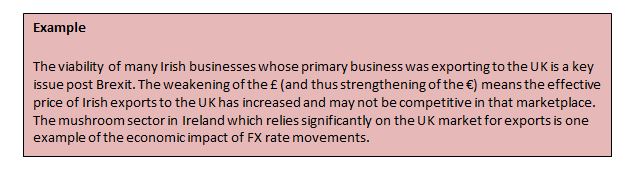

Economic Risk – This is a longer term risk exposure regarding the impact of changes in FX rates on the value of a company. This risk might be either direct or indirect depending on the company.

Bid-Ask Spread

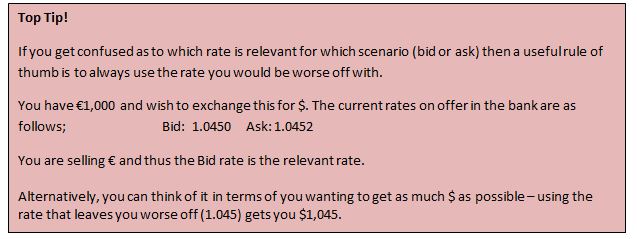

One common issue that students struggle with when dealing the FX rates is the concept of the bid-ask spread. When dealing with foreign currency transactions there will be two FX rates quoted for each currency pair – the bid and the ask rates. The bid rate is used when you are selling the relevant currency and the ask rate is used when you are buying the relevant currency.

The bank, credit union etc. make their money (in addition to any commission or admin fee) by charging you a different rate depending on whether you are buying or selling currency. This difference between the bid and ask rates is called the spread.

Bid – how much the dealer will bid you (i.e. you are selling)

Ask – how much the dealer is asking for currency (i.e. you are buying)

Accounting Standards & FX Risk

Recognising the importance of foreign exchange risk, companies are now required under International Financial Reporting Standards to disclose their exposure to FX risk and its impact on the business. IFRS7 requires both a qualitative and quantitative disclosure with respect to key risks, including FX risk. This note disclosure can be very informative about the business and how it manages its risk exposures.

Two good examples of these disclosures are;

DCC Annual Report 2016 Note 5.7 page 184

Greencore Annual Report 2016 Note 21 page 138

Nerd Corner

For anyone with a deeper interest in foreign exchange, see the below link to a survey about the size of world FX markets, the most traded currency pairs and the biggest market locations etc.

Summary

FX risk concerns have been brought to the fore in recent months in Ireland given Brexit and the movement in EUR/GBP rates. FX movements can have a major impact on a business either directly or indirectly and it is important that businesses manage this risk effectively. Businesses can be exposed to different types of FX risks, some short term, some more longer term and some having cashflow impacts while others only have a financial statements impact. Understanding what FX risk a company has based on its business model is the first step in effectively managing its exposure. The next step is to put in place a plan to effectively manage (or “hedge”) this FX risk exposure to avoid any adverse consequences to the business – this will be the focus of the next post on FX Risk.

no comments