Real World Read – AIB [Tax Losses & Deferred Tax]

It is not often that the worlds of deferred tax accounting, politics, and mainstream media intersect but the build up to the recent IPO of AIB was one such time. To say deferred tax is one of the most hated standards for students is an understatement, but the AIB IPO provides an interesting (ok, perhaps a stretch) example of the accounting for deferred tax on tax losses and also how these can be an important consideration for company valuation purposes.

Ultimately the term deferred tax is somewhat misleading as it is really just an accounting adjustment to account for the timing differences between how certain items are treated for accounting purposes (e.g. under IAS/IFRSs) and how they are treated for tax purposes. The recent story of the historical losses that AIB incurred over the period of the recent economic downturn has brought deferred tax accounting into mainstream business news. In general, the tax rules will allow companies that incur losses in one year to offset those against future profits in future years. Thus the previously incurred loses have a significant value to a business – in that they will reduce future tax bills – and thus, under IAS12, an asset can be recognised for the value of the tax saving in the future (Assuming certain criteria are met).

Tax losses are an important part of deferred tax and have their own section in the standards (para 34-36 of IAS 12) which requires that a deferred tax asset with respect to the tax losses can only be recognised to the extent it is probable future taxable profits will be available against which the losses can be used. Take a read of the below PDF document which is an extract of the 2016 AIB annual report which discusses how they recognised the deferred tax asset in respect to previous losses.

You should note the following key areas;

- Deferred tax noted as a key audit risk in the Independent Auditor’s report – page 3 (of PDF);

- Deferred Tax asset of €2.8bn in the SOFP on page 8;

- Accounting policy note on deferred tax on page 9-11 (Note the length & detail); and

- Deferred tax note on page 12-14.

The full AIB 2016 Annual Report is available here

While it may not be the most existing of areas, the AIB tax losses story provides a great example of how deferred tax works in practice and the accounting implications – in particular, from a commercial perspective, this accounting treatment meant that AIB has less capital to raise to meet regulatory capital requirements as the deferred tax asset was acceptable for testing purposes – see more re this here if you are interested)

Side Note: Deferred Tax Asset & Company Valuations

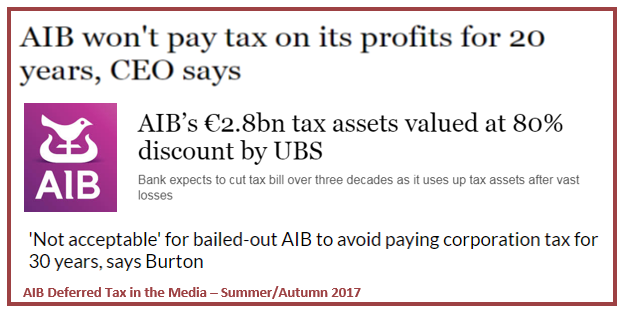

An interesting side note to the deferred tax issue is how such an asset is valued for the purposes of the IPO. The Irish Times covered a short article on how UBS valued the €2.8bn deferred tax asset at an 80% discount to its book value. The valuation approach was to discount the future cashflows (i.e. the future tax savings) using an appropriate cost of capital (to account for time value of money) and then to also take a discount for political and regulatory risk (e.g. if the government restricts the ability of AIB to offset tax losses against future profits in the future – as has happened in the UK).

no comments