Lease Accounting – IFRS 16 & Tesco

The landscape for lease accounting has taken a significant change since 1st January 2019 with IFRS 16 now replacing IAS 17 in accounting for leases. This new standard has been over 10 years in development since the first discussion paper was released by IASB back in 2009. It represents a fundamental change to accounting for leases and will have a significant knock on impacts to financial statements of a lot of companies.

See here for the history of the development of IFRS 16.

IAS 17 Problems

Problems with lease accounting under IFRS 16’s predecessor, IAS 17, have been well flagged for years. The classification of leases as either operating or finance was at the crux of the issue. With many companies structuring leases to ensure they fall under the operating lease category rather than a finance lease, this meant that significant liabilities (i.e. the future lease payments) and the associated assets remained off-balance sheet and did not provide a realistic picture of the true debt position of the company.

This led to the undesirable situation where many analysts and other financial statement users had to try to manually adjust reported profits and debt figures to try to capitalise the operating lease liabilities to allow accurate comparisons across companies.

Highlighting the issues with IAS17, Sir David Tweedie, previous head of IASB, provided two memorable quotes around the area of lease accounting in the early to mid 2000’s

“We all have leasing standards, and the great news is these leasing standards are perfectly harmonised worldwide,” he told the audience. “They are all absolutely useless. None of them work.”

“One of my great ambitions before I die is to fly in an aircraft that is on an airline’s balance sheet”

New Lease Accounting – Enter IFRS16

IFRS 16 removes the choice of operating or finance lease classification for leases. Almost all leases will now be capitalised by recognising the lease liability and the associated right-of-use asset on the statement of financial position. This should ensure that the financial statements better reflect the true debt position of the company and should also allow easier comparison of companies that lease assets and those companies that borrow money to buy the assets outright.

Under IFRS16 the operating lease expense will be removed and replaced by a depreciation charge for the right-to-use asset, along with finance costs associated with the lease liability.

The IASB also published a detailed effects analysis which looks at the costs, benefits, and implications of the new leases standard. It is available here and while it is long, take a look at the executive summary and table of contents on page 3-6.

Tesco and IFRS 16

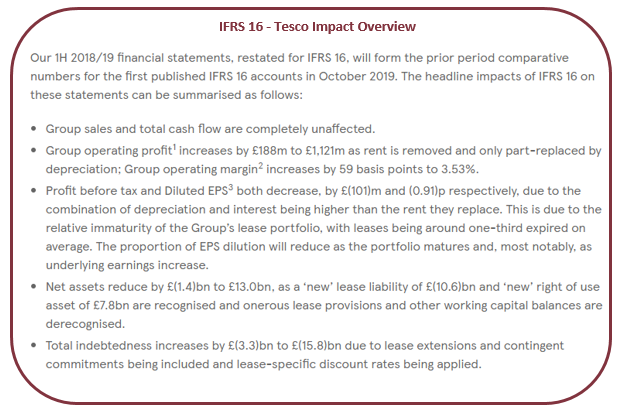

Tesco provide a good example of how companies are adjusting to IFRS16 and also how they are informing investors of the impact the standard will have on financial statements. This is important as the adoption of IFRS16 will result in significant changes to key financial performance lines (e.g. operating profit, earnings per share, net assets, total debt). With over 9,000 leases in the company, the transition was a significant undertaking and took over 2.5 years from start to implementation of IFRS 16.

Last month, Tesco held an IFRS 16 briefing for analysts and investors and they have restated their H1 2018/19 accounts to illustrate the impact IFRS 16 will have – a summary outline of impact is provided below (from here).

See the below links for more detailed information about Tesco’s transition to IFRS 16 and the impact it will have on its financial statements;

Tesco IFRS 16 Presentation – Feb 2019

Tesco IFRS 16 Briefing – Feb 2019

no comments