Accounting for Football Players – IAS38

I’m always interested in the application of accounting principles to areas that people would not necessarily associate with accounting (anything that keeps students’ interest in the subject!). One such area that I have been reading about recently is that of football clubs. The introduction of Financial Fair Play (“FFP”) in recent years has put a renewed focus on the business aspect of football clubs and their sustainability from a financial perspective (see here for more details).

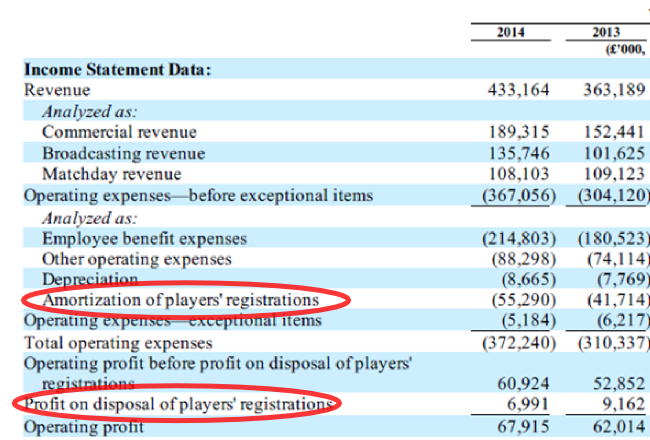

I read with interest an article recently that looked at how much “FFP cash” was available to Chelsea to purchase new players. It went on to explain how player signings, disposals and wages are treated for FFP purposes in the club’s accounts and it was a great example of the application of basic accounting principles. The initial capital outlay (i.e. the transfer fee) is amortised over the contract of the player while the wages are an annual expense to the SOCI. In terms of the disposal of a player, it is again a standard accounting adjustment where you compare the disposal proceeds to the “book value” of the player and record a profit or loss in the SOCI.

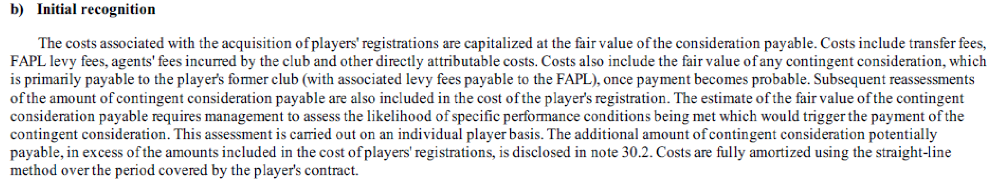

For those of you who are interested, the accounting for player transfers (known as “player registrations”) falls under IAS38. The expenditure on player transfers (including directly related costs such as agent fees, signing on bonuses etc.) are capitalised and amortised over the useful life of the asset (i.e. contract term). Below are just extracts from Manchester United’s most recent annual report which give an insight into how the player costs are accounted for.

Source: Manchester United Annual Report 2014

For those interested about how clubs account for impairments in players’ value (e.g. injuries etc.) have a read of page 14 of Tottenham Hotspur’s 2014 Annual Report which deals with its application of IAS36.

no comments