Foreign Exchange Risk (Part 2) – Internal Hedging Methods

In our first post looking at FX risk we explored how various events can have a significant impact on FX markets, how businesses can be exposed to FX movements, and how the market dynamics work in terms of FX rates (e.g. bid-ask rates). We will now turn our attention to the matter of managing FX risk exposure(s) for a business. Typically, responsibility for this area would fall to the finance or treasury function in an organisation, depending on its size and frequency of FX risk exposure. In this post we will examine the internal methods for hedging FX risk and in the final post of the FX risk series we will focus on the external hedging methods.

Why manage FX risk?

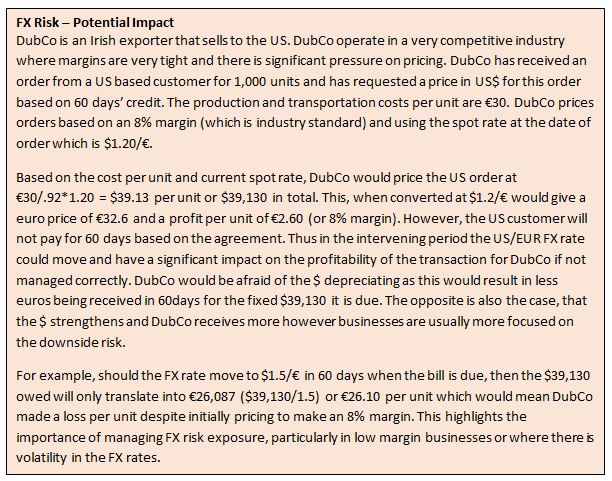

There can be a number of reasons why firms would look to manage their FX risk exposure but the predominant reason is to provide some certainty in terms of either their costs and/or revenues that are denominated in a foreign currency to assist with budgeting and planning. Typically, the finance or treasury team will forecast out the relevant foreign currency denominated costs and revenues for a period (e.g. six months) and put in plan a place to manage this FX risk exposure proactively.

Each business will have a different risk management policy in terms of FX risk, some will seek to hedge all exposures, while others may only do so on an ad-hoc basis as the need arises. If a particular transaction is material to the business or, as the example below illustrates, the business is a low margin one where a swing in FX rates can wipe out the profitability of a sale, then it makes sense from a company’s perspective to manage their FX risk closely. This will avoid the possibility of negative movements in FX markets having a significant impact on the performance of the business.

Hedging Methods

There are a number of methods available to businesses to manage their FX risk exposures. The methods can broadly be classified into two groups – internal and external. Internal methods, that is methods within the business itself, tend to be cheaper and easier to arrange however they may not be available to all businesses depending on their circumstances. External methods involve dealing with a third party (typically either a bank or exchange) and are more formal transactions than internal methods and will usually involve transaction costs.

The most appropriate hedging method will depend on the risk you are looking to manage. For example, is it a short specific exposure (e.g. transaction risk from a sale to a US customer in $) or is it a more longer term exposure (e.g. 10 year $ denominated loan or expansion to the UK market with £ revenues and £ costs), the circumstances of the business (e.g. are internal methods available?), and the currencies involved (some currency pairs are easier to hedge than others depending on the level of activity – the rarer the currency, the more expensive and limited your options will be).

A further consideration is whether the exposure is contingent or certain. A contingent exposure could be something such as a £ based tender that your business may/may not win but could expose you to FX risk if successful. For risks such as this, you would want a flexible method that does not lock you into any specific transaction/rate – typically an FX option is used in this instance, which we will discuss in more detail in the final post of the FX risk series.

Internal Methods

Internal hedging methods are those available within the business itself. These typically should always be considered before resorting to external methods as they can be cheap and relatively straightforward. However, some businesses may not have all the methods available to them. Internal hedging methods include the following;

Do Nothing

Make no attempt to manage FX risk. Exposes the business to upside and downside movements in FX rates. May not be feasible if company has large FX transaction or is a low margin business. Business saves transaction costs with this policy as no hedging involved.

Invoice in home currency

A business can transfer all the FX risk to their customer if they invoice in euro. However, this may result in lost sales especially if they are in a competitive industry. Customer may not want to have FX risk exposure.

Risk Sharing

Business and customer enter into an agreement that both will share any FX movements between the date of transaction and date of payment. Split can be determined by negotiation. Less extreme method than invoicing in home currency (where 100% of risk is pushed onto customer).

Leading and lagging

Cashflow management methods whereby the business will seek to pay/receive foereign currency denominated payments/receipts earlier or later depending on the expected movements in FX rates. For example, if a business with a customer with an FX receivable expects that the currency it is due to receive will depreciate over the next three months it may try to obtain payment immediately. This may be achieved by offering a discount for immediate payment. One assumption here is that the business can reasonably forecast movements in FX rates.

Matching

When a business has income and expenditure in a foreign currency then it can operate a bank account in that currency and match them against each other, removing the need to translate them all back to euro first. The business then only needs to translate the surplus back into euro, saving on transaction costs.

Summary – Internal Hedging Methods

Overall, internal methods can be very effective and with relatively little cost. However, some or all of those methods may not be available to all businesses (e.g. business may not have corresponding costs/revenues in same currency to match or may not be in a position to dictate with customers which currency an invoice will be issued in) and thus they will likely have to make use of external methods to manage their FX risk – which will be the focus of our last post on FX risk.

no comments