Share Buybacks – The Good, The Bad, & The Ugly

A recent announcement from the UK government that they are undertaking a study on the impact of share buybacks and the possible role they are playing in the inflation of executive pay has put this particular practice in the headlines. From a basic corporate finance perspective, share buybacks (also known as share repurchases) are a method of returning cash to shareholders – with the other main method for this being through the payment of dividends.

Although both return cash from the company to its shareholders, share buybacks and dividends do have some key differences;

- Buybacks and dividends are taxed differently – dividends are taxed at income tax rates while most share buybacks will be taxed at capital gains tax rates – this links back to the concept clientele effect when studying dividend policy;

- Paying regular dividends sets an expectation – when dividends are paid, investors typically expect these to be maintained or grow year on year (an exception might be a special divided) – share buybacks are not like this and can be a one off and thus are a lot more flexible than dividends;

- Share buybacks alter ownership structure and key metrics – buybacks by definition reduce the number of shares which can impact key metrics like EPS and ROE, dividends do not.

- Buybacks are more flexible that dividends in that not every shareholder has to have their shares bought back (e.g. you could use it to buy out one particular shareholder) whereas every shareholder must get paid the same dividend.

- See more here

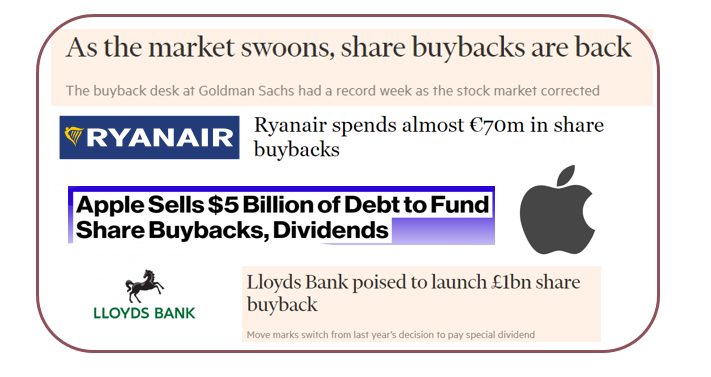

There remains significant debate about the value or otherwise of share buybacks – they had been previously banned. Buybacks have become an increasingly popular mechanism to return significant amounts of cash to shareholders as evidenced by a (small) collection of recent headlines below. While some argue that buybacks have become a type of financial engineering that has been the downfall of financial markets in the past decade and they are being used to manipulate key metrics for various value destructive purposes, others argue that it is perfectly legitimate way to return surplus capital to those who own the cash (i.e. the shareholders).

Some other key points to note about share buybacks are provided below (many of the points are not necessarily easily categorised into good or bad hence they are shown together);

- Buybacks are a valid way of returning surplus cash to investors if the company has no use for it – rather than it sitting in a deposit account. See Apple and its run in with activist shareholders who demanded it return the cash it was hoarding to shareholders;

- Buybacks can increase the value of a firm that is under-levered by increased the gearing level using a debt funded share buyback (i.e. replacing equity with debt) and reducing the overall firm’s cost of capital;

- Buybacks, when announced, can also send a signal to the market. This signal can be either interpreted as positive (management considered the shares to be undervalued and that is why they are buying them) or negative (management have lost the ability to identify new investment opportunities and future growth will be slower);

- Buybacks can result in an increase in the EPS ratio without any change in the firm’s underlying profitability (due to the reduction in the number of shares). Depending on the market pricing reaction this can actually mean the share price increases on the back of the share buyback even though the fundamentals of the business have not changed;

- Buybacks can also potentially be used to manipulate EPS for the purposes of hitting earnings targets, which are often a key target as part of management compensation plans. This is what the recently announced UK government research is looking at.

Key Readings

The Case for Stock Buybacks – HBR

Profits without Prosperity (The Case Against Stock Buybacks) – HBR [Incl Video]

Stock Buybacks: Misunderstood, Misanalyzed and Misdiagnosed – Aswath Damodaran

The repurchase revolution – The Economist

no comments