Formula Frustration

One difficulty that many students encounter when studying finance (and also some areas of management accounting) is the various formulae that are required. From WACC, IRR, NPV, time value of money, bond valuation, there is a vast collection of formulae to understand and remember. (Some exams do provide a formula sheet but reliance on this is dangerous and students should attempt to understand the formula and its components as opposed to merely “learning it off”)

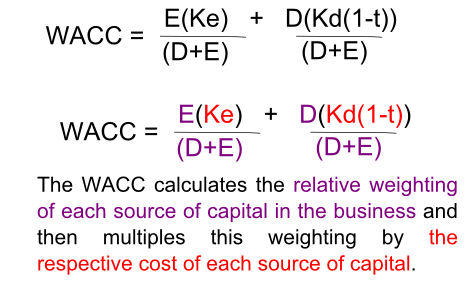

One useful approach that I show to students (I picked it up from a tweet a year or two a go but cannot seem to remember where) when studying formulae is to take a colour coded approach. This gives students a visual link between the actual formula and the narrative description accompanying it and should make it a lot easier to understand what the formula is trying to do.

An example of this approach for WACC (weighted average cost of capital) is provided below:

Note: This is, of course, a basic WACC formula with only two sources of capital but the general colour coding principle can be extened to a more detailed WACC formula also.

Such an approach could also be very useful for variances in management accounting.

Can you please send on the formula sheet you use for SFMA.

Thanks

Hi Alex,

As CAP2 SFMA is an open book exam, there is no standard formula sheet like CAP1 Finance and I encourage students to prepare their own ones to suit their needs. I am a fan of getting students to prepare summary study sheets (or cheat sheets) for each of the main areas which would include key formula and reminders of tricky areas. You would have these for all core areas such as WACC, company valuations, variances etc. I am happy to take a look at the ones you prepare as you go through each topic to give you some tips and advice.

John